LEVATUS Investments | Why Inflation Feels So Bad In Three Short Snapshots

A disquieting apprehension about inflation has drifted into the public consciousness. The headlines say that inflation is better. Why don’t we feel that way?

Susan Dahl | CEO LEVATUS

Photo by Fabio Santaniello Bruun

In the news, the story is that inflation is better. Why don’t we feel that way? One reason - the story of inflation is largely being told from the perspective of month-to-month change, rather than the longer view of how high prices have become. Another factor – inflation reports often strip away the effect of some pretty important life essentials. Let’s take a quick look under the hood.

PRESENT | The Components of Inflation

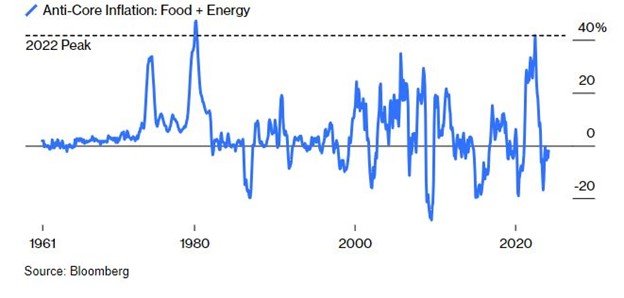

In many inflation reports, price increases in food and energy are removed to arrive at what is called ‘core inflation’. Economist reason that both food and energy are highly volatile and mostly cyclical, so they can unnecessarily distort the data. In essence this means that over time the ups and downs in these prices are expected to average out someplace in the middle, so they are removed in order to make the data less volatile. The thing is, food and fuel have a substantial impact on everyday life. To get a different perspective, the following two charts look at only food and energy, the ‘anti-core’.

The first chart shows that after the second worst price shock on record during the pandemic, the ‘rate of change in inflation’ has indeed returned to a more normal level. This is what propels the ‘positive’ narrative around the improvement in inflation. Prices are no longer rapidly pushing higher each month. They are however, still moving higher from what was a very substantial spike.

As is visible in the chart, even very recent reports of slightly hotter inflation are just a tiny blip in comparison to the swings experienced during COVID.

PAST | The Level of Prices in Absolute Terms

The trouble with a narrative that is focused on the ‘rate of change’ in prices, is that it misses the larger point about where prices are in absolute terms. The rapid spike in inflation during the pandemic has left food and energy prices close to 20% higher than they were a few short years ago.

This is probably why inflation feels bad, even though the headlines and U.S. Federal Reserve regional banks are reporting it is ‘much better’.

Note: Pre-GFC = Pre-Great Financial Crisis of 2008. During more than a decade long period subsequent to the crisis, food and energy stayed below their prior peak.

FUTURE | The Expectations for Inflation

Part of the reason this recent sudden spike in food and energy is so jarring, is that the change over the previous decade was fairly contained. This experience impacts the future by influencing our expectation for inflation. Because our brains weigh recent experience much more heavily our fears have become heightened. We went from assuming that inflation would stay flat, to fearing it would act as it has over the past 3 years. With that recent experience, inflation expectations are likely to react much more quickly to any hint that inflation is returning.

From an economic perspective, the reason this matters is that this impulse has the potential to become self-fulfilling. According to the US Federal Reserve, ‘Economists and economic policymakers believe that households' and firms' expectations of future inflation are a key determinant of actual inflation.’ US consumers that had become used to the unusual lack of upward momentum in prices over the past two decades, are now primed for more inflation.

The green line in this chart reflects inflation expectations, an important data point to continue to monitor as prices once again begin to rise. Our inflation piece ‘Unraveling the Inflation Conundrum’ has more detail on the various components and drivers of inflation in the post pandemic world. For now, inflation expectations are contained. What they do in the face of now rising ‘rates of inflation’ will be quite consequential.

investment, Tax, estate

Distilling complex topics down to their essence is a hallmark of the LEVATUS approach.

ABOUT THE AUTHOR

Susan Dahl is a seasoned executive, industry leader, and dedicated client advisor, with over thirty years of international and domestic financial experience. Susan is known for her ability to unravel complex questions, and has a steadfast commitment to well designed process. This background has translated directly into her work on investment process design for private wealth clients, as well the innovative LEVATUS approach to financial advisory services; a modern design that addresses quality of life in specific, direct and tangible ways. A deep and diverse background that extends from global investing to risk management to process development and planning, has laid the groundwork for an advisory solution that asks more of wealth. Susan shares some her most recent work in this TEDx , Can Happy Make You Money?

ABOUT THE AUTHOR

Keith Savard has more than 40 years of economic/finance research and investment experience in the United States and overseas. He has worked as a staff member at the Board of Governors of the Federal Reserve System and as an international economist at the U.S. Department of State. A solid background in macroeconomic analysis and financial regulatory and monetary policy issues, combined with sovereign and credit risk skills, has enabled Keith to offer investors actionable top-down investment strategies and expertise facilitating a broad-range of asset allocation decisions. His deep knowledge and understanding of emerging markets, gained through extensive travel and meetings with cabinet-level officials, company CEOs and local investors, affords opportunities to invest confidently beyond the U.S.

A disquieting apprehension about inflation has drifted into the public consciousness. The headlines say that inflation is better. Why don’t we feel that way?